MARKET INSIGHTS: Engineering and finance can partner to drive product development

JASON MULLINER

As budgets get squeezed within photonics companies, more ideas are competing for fewer R&D dollars. The result is that corporate finance is now playing a larger role in the selection of innovative projects within both small and large organizations. A combination of financial and engineering approaches to R&D will enable these companies to develop the most innovative and profitable products.

R&D projects at photonics companies can come in many forms. In research organizations, spending for multiyear projects can be used both to purchase hardware and employ human capital. The product development stage is similar whether a technology is developed in the lab or derived from market need. For example, Edmund Optics developed the Aspherized Achromatic product line because of the specific market needs of customers who were looking to integrate aspheres into their systems at a reduced cost. The product line aims to provide the performance of an asphere at the price of an achromat.

In the photonics industry, R&D is increasingly tied to the factory floor and can be classified as projects that accomplish two types of goals: an increase of capacity or an expansion of capability. Each of these options has different risk profiles, timelines, and costs in terms of human capital and traditional capital expenditures such as machines and devices.

These differences must be quantified and modeled, thereby removing any of the engineering bias that can cloud decision-making. Often, the greatest idea for a completely new product could turn out to produce poor financial returns when compared to higher returns on future iterations of existing products.

To evaluate the merits of a particular project, a simple financial tool is used to analyze the benefit of a project to the organization. A cash flow analysis using the present value of future cash flows is one of the best determiners for examining the viability of a given project (see box).

defined as the sum of the present values at time t of the individual cash flows of a project with r as a predefined discounted rate.

This tool has been around for decades but is not uniformly used at smaller technology companies. The tool recognizes that cash spent or gained in the future is worth less in the present. In other words, cash flows in the future must be discounted to the present. To determine the true value of a multiyear project, you must discount the cash flows at each year of the project.

A few important factors are considered to complete the cash flow analysis. First, an accounting of the yearly cash flows for a given project must be determined for the life of the project. For each year, you must take into account any real expenses associated with the project such as capital equipment purchases, extra engineers, and extra sales and marketing to make the project successful. You must also factor in the profit associated with the project that results in cash generation. The sum of these simplified inputs gives a cash flow for the given year.

At first glance, it may appear that this is a traditional "income statement" for the projects, but there are several accounting rules used in an income statement that should not be used in a cash flow analysis. First, you do not take into account depreciation of a marginal asset used in the project. Its cash flow is fully used in the year that the purchase is made; subtracting for depreciation would be double-counting. Likewise, any allocation for inventory, increase in receivables, or payables must be accounted for in the project cash flow analysis. That is why it is difficult to equate the project cash flow analysis with a standard financial statement; it is essentially a hybrid of an income statement and a balance sheet.

Another important factor for the equation is the discount rate (r in the equation) or hurdle rate which is used to discount the cash flows. For most organizations, this may be some derivative of the weighted average cost of capital (WACC). The WACC contains the opportunity cost of the capital, which is either debt or equity, employed for assets.

Using solely this cost of capital to discount projects can be misleading for determining the project feasibility especially for those which are new ventures or are increasing manufacturing capability. Since not all new ventures succeed, risk should be calculated and added to the cost of capital to determine the true project hurdle rate:

Determining these risk factors and their numerical value is a firm-specific endeavor but it is beneficial to capture the true cost of new projects, especially when numerous projects are vying for a limited amount of capital. Typical values for hurdle rates range from 8% to 15%.

Finally, a suitable end date for the project must be determined. A typical window of 5–7 years is used, but it can vary based on the company, industry, and type of project. In order to provide an accurate assessment of the project, you must model a disposal of the assets or calculate a terminal value, which is merely a value of severely discounted cash flows, into perpetuity. The latter method is useful for valuing companies while the former is more suited for projects, even if the intention is not to sell off the assets at the arbitrarily assigned project end date.

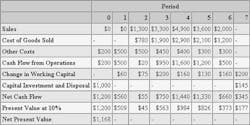

Let’s look at an example. Suppose you want to add a new product line to your current product mix. This new product will require hiring a couple of new engineers who have additional skill sets over the current team. In addition, some new capital equipment will be required for the design, prototype, and manufacture of the new product. Sales and marketing have also decided that a special business development person will need to be hired to sell this product in the particular vertical market, and marketing will need to attend some additional tradeshows and run some ads in new trade journals. Instead of using a perpetuity value calculation, we simplified and assumed an unwinding of the project after 7 years. This does not indicate that the project must be shuttered after 7 years; it just proves that the project is feasible financially, even if it is shut down after 7 years. Also for this analysis we will ignore the beneficial impact of depreciation on taxes on the cash flow analysis (see table).

Sales: These are the forecasted sales of the product, including both potential geography mix (use a consistent exchange rate for any international sales) and potential discounting. Cost of Goods Sold: This is the cost to build the product, including raw materials, any direct manufacturing labor, and a modest allotment of manufacturing overhead. Do not include any depreciation of capital equipment since it is a non-cash expense and is already included in the cash flow. Other Costs: These are the additional costs in marketing, extra headcounts in sales and R&D, and any other marginal costs associated with this project. Change in Working Capital: This is the cash flows related to an increase in accounts receivable from the additional sales, the increase in accounts payable attributable to the increased manufacturing, and the increase in inventory to service the customers. Capital Investment and Disposal: This is the initial investment in machinery and other equipment to design, prototype, and manufacture the product. Also, the hypothetical unwinding of the CapEx at the end of the project. Present Value at 10%: This is the discounted cash flows in each of the periods. Net Present Value: The sum of the investments in Period 0, with the discounted cash flows of the subsequent periods. |

The results of the analysis show that this project is Net Present Value (NPV) positive, or "NPV positive." The goal is to invest in projects where NPV >0. The value of the NPV calculation does not mean that the project was profitable by $1168; it merely means that it was profitable above and beyond the hurdle rate, which was pegged at 10%. Further analysis, including the Internal Rate of Return, can provide more insight into how financially profitable this project would be as compared to other projects.

By using this discounted cash flow technique, the most profitable projects get the funding and go-ahead while the less profitable do not. Arguably, using a strict financial model may limit innovation; many of the great leaps forward in technology had very risky profiles and dim prospects for success at the onset. When appropriately used, this technique will allow engineering and financial managers to clearly understand the costs, risks, and potential rewards in developing new products.

JASON MULLINER is executive vice president of finance at Edmund Optics (Barrington, NJ; www.edmundoptics.com). He has a BS in electrical engineering and an MBA in finance from the Wharton School at the University of Pennsylvania; e-mail: [email protected].