The financial earthquake that rattled worldwide economies in 2008/2009 has subsided, but aftershocks continue; European debt and a possible slowdown in China give laser companies pause against the comparatively calm (and lucrative) backdrop of 2010/2011.

The laser markets survived “the big one”—the global economic recession of 2008/2009—and recovered nearly all their losses by the close of 2010. By all measures, 2010 and early 2011 were more favorable for laser manufacturers than anyone could have predicted. But just in the last quarter of 2011, orders began slipping out for some customers, and worldwide stock markets continued their wild vacillation on alternating good- and bad-news reports surrounding the European sovereign debt crisis and a possible slowdown in China just to name a few: aftershocks from the big one, or foreshocks of another recession to come?

More Laser Articles |

“Fears of a recession in Europe and a significant slowdown in China are certainly well-founded, but depending of the severity of a downturn in these regions, there should still be positive developments in other regions of the world, particularly the US,” says Mark Douglass, senior equity analyst–industrial technology, for Longbow Research (Independence, OH). “More specifically, domestic industrial markets will likely continue to invest in automation equipment, where lasers and photonics oftentimes are enabling technologies, with companies looking to improve productivity while limiting hiring. Unlike banking and housing, the industrial economy is flush with cash, ready and willing to invest not only in M&A but also in upgrading existing facilities—they’re certainly not getting any benefit having it sit in a bank.

“Markets like automotive continue to invest significantly in lasers and even expand addressable markets with new applications, while oil and gas, agriculture, construction equipment, medical device, and food and beverage industries continue to spend on photonics technology,” Douglass adds.

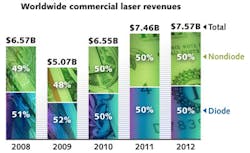

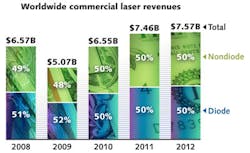

Worldwide laser sales reached $7.46 billion dollars in 2011, growing 14% compared to 2010—3% higher than our 11% growth forecast last year. But for 2012, we see aftershocks from the great recession continuing for a while longer, with negative news stories hopefully balanced by a continuing increase in personal electronics sales, as well as growth in manufacturing cost-reduction and automation strategies that welcome more machine-vision and laser tools. For 2012, Laser Focus World forecasts laser sales to grow a modest 1.2% to $7.57 billion.

Déjà vu?

Our Laser Focus World Annual Review and Forecast report published in January 2009 was appropriately titled “Photonics enters a period of high anxiety.” By late 2008, worldwide stock markets had already tumbled 30% in advance of the great recession that would follow, and laser sales would drop an unprecedented 23% in 2009. Fortunately, 2010 saw worldwide stock markets and laser sales recover very nicely, just in time for the upbeat 50th anniversary of the laser celebrated in 2010. And even though the laser market growth trend continued into 2011, the European debt crisis is front and center and 4Q11/1Q12 is looking a little like pre-recessional 3Q08.

Most economists agree that the great financial recession was triggered by the US housing crisis and magnified by credit default swaps and other high-risk derivatives—the total value of which, by some estimates, exceeds global gross domestic product (GDP) by a factor of ten.

But despite the admissions, have any financial lessons been learned? In his Oct. 19, 2011 address at the Federal Reserve Bank of Boston’s 56th Economic Conference, that bank’s president and CEO Eric S. Rosengren said, “Credit default swap (CDS) rates for many countries are now very high by historical standards—meaning the cost of insuring against a sovereign default has risen appreciably.” Essentially, Rosengren says that the asset size of many national banks is still a dangerously large percentage of that home country’s GDP. Despite worldwide attempts at financial regulation, Rosengren warns, “Significant challenges remain to be addressed if we are to have a global banking system where no bank is too big to fail given the collateral damage it would cause to economies and citizens.”

That financial markets remain risky and credit for new product development is difficult to obtain has many in the photonics industry on alert. “The days of NINJA loans—No Income, No Job, no Assets—are over,” says Philip Crowley, CEO of MarketTech (Scotts Valley, CA). “Banks aren’t lending because they’re being told to build reserves; and the smaller the company, the bigger the perceived lending risk for the banks. It feels like the mid-1990s when banks treated you like a small company if your revenues were below $10 million.” But Crowley does acknowledge that not all lending resources are tight: “There is a lot of private capital out there if you have a winning technology with a compelling story—just be ready to give up a big equity stake in your company.”

Lending troubles aside, we learned all too painfully in the great recession that laser markets are heavily tied to consumer spending and overall GDP trends. So what do the latest GDP statistics tell us? In Europe, Eurostat (epp.eurostat.ec.europa.eu) reported that Euro-area (16 countries) GDP growth rate will hold relatively steady, with 2010 growth rates at 1.8% and forecast at 1.6% and 1.8%, respectively, for 2011 and 2012—a phenomenal improvement considering the negative (-4.2%) growth rate for 2009. And in August 2011, industrial new orders rose by 0.7% compared to the previous month and a full 5.0% compared to August 2010 (excluding more volatile ships, railway, and aerospace equipment orders)—a positive trend that bodes well for laser materials processing markets going into 2012.

Across the Atlantic, the US Bureau of Economic Analysis (BEA; www.bea.gov) says GDP in the US bounced back into positive territory after 3Q09 and saw quarterly increases into 2010 at around 3.8%; however, it has fluctuated ever since. It nearly approached negative territory in 1Q11 before rebounding at a slower pace to an anticipated growth rate of 2.5% for 3Q11, with 2011 overall GDP growth rates revised down to 1.6–1.7% as of November 2011 from the more optimistic growth rates of 3.4–3.9% of January 2011. The US Federal Reserve attributes its downward revision—which reduces the 2012 and 2013 GDP growth rates nearly a percentage point from earlier estimates to 2.5–2.9% and 3.0–3.5%, respectively—to weakness in overall labor market conditions and the elevated unemployment rate.

So yes, the US jobless recovery continues, with unemployment estimated by the Federal Reserve to still be as high as 7.8–8.2% by 2013. And even though the US Purchasing Managers’ Index (PMI) showed growth as of October 2011 for the 27th consecutive month at 50.8% (perhaps due to the falling value of the dollar), the JPMorgan Global PMI was nearly flat at 50.0%, indicating worldwide manufacturing stagnation for the third straight month.

Even higher than the US, Eurostat reported Europe’s unemployment rate at 10.3% in October 2011. And while Trading Economics (New York, NY) reported that Japan’s unemployment rate actually fell from around 5% in early 2011 to a low 4.1% by October 2011, Japan’s 2011 quarterly GDP growth rates hover in negative territory between -0.5 and nearly -1.0% in large part due to the very real and tragic March 2011 earthquake and ensuing tsunami.

The GDP and employment picture for emerging nations is less scary but should keep laser manufacturers on edge. For 2011, the National Bureau of Statistics of China reported that GDP (which at nearly $5.9 trillion exceeds Japan’s approximate $5.5 trillion and only trails the US and Europe GDP totals at nearly $14.6 and $12.5 trillion, respectively) grew at an annualized rate of 9.4% from 1Q–3Q11.

While still outpacing nearly all other countries, GDP growth rate in China, according to Trading Economics data, has been in steady decline since its post-recessional recovery to around 10%. If you consider that as of 3Q, India’s (GDP around $1.7 trillion) and Brazil’s (GDP nearly $2.1 trillion) 2011 GDP growth rates are forecast to hold at about 8% and 4% following pre-recessional highs of nearly 10% and 6%, respectively, the worldwide GDP trend beyond 2011 is either flat or in decline.

Made in China

“To understand how the economy will fare beyond 2011, watch China,” says Larry Marshall, a managing director of Southern Cross Venture Partners (Palo Alto, CA) and author of the Larry’s VC View blog for Laser Focus World. “China over-spent and over-invested; some factories are sitting empty, and Chinese workers are demanding higher salaries—all raising the probability of a double-dip US recession.”

Marshall is not alone in his sentiment. “If you really want to know what could blow up your portfolio for years to come, forget Europe. What you should really be concerned about is a potential Chinese bust,” said Reuters contributor Chris Taylor in a Yahoo! Finance article. Taylor points out that the Chinese stock market is near its two-year low, GDP growth is in the low 9% range after years of double-digit gains, and the government’s stockpiling of foreign-exchange reserves has been slowing to a crawl. “Bearish observers single out the twin trends of easy credit and rampant overbuilding—sound familiar?—that have led to ‘ghost cities,’ a blizzard of new developments and skyscrapers that have been erected and now lie virtually empty,” adds Taylor, noting that the situation “… can’t be sustainable.”

Research and Markets (Dublin, Ireland) says that China’s laser equipment market reached $582 million dollars in 2010, with a compound annual growth rate (CAGR) of 21.7% from 2001–2010. High-power laser equipment for cutting, marking, and welding accounts for 67% market share, and there are approximately 200 enterprises—foreign and domestic—involved in assembling laser equipment in China. Clearly, a slowdown in the Chinese economy would have a negative impact on worldwide laser sales.

Now the good news

Mirroring worldwide stock market and GDP recoveries in 2010 and 2011, most laser companies saw double-digit growth during this period. But more importantly, TRUMPF (Ditzingen, Germany), Rofin-Sinar Technologies (RSTI; Hamburg, Germany and Plymouth, MI), IPG Photonics (Oxford, MA), and Coherent (Santa Clara, CA) were among the many laser and photonics manufacturers that saw record sales through calendar 2Q and 3Q11.

For the period ended June 30, 2011, TRUMPF saw the largest revenue increase in its entire history—a 51% sales increase compared to the prior fiscal year to $2.78 billion dollars (€2.024 billion). “Following the major declines during the recession years, we now have strong growth in all the world’s regions—most particularly in China, but also in Germany and the American markets,” says Nicola Leibinger-Kammüller, TRUMPF president and chairwoman of the Managing Board. Looking ahead to the current fiscal year, says Leibinger-Kammüller, “We’re expecting double-digit growth. However, there are also signs that because of the Euro crisis, growth will be far slower than last year.” TRUMPF is currently doubling its production capacity in China with the extension to its factory in Taicang near Shanghai to open in the spring of 2012.

Rofin-Sinar, who—like TRUMPF—plays primarily in the laser materials processing markets, saw 41% net sales growth to nearly $598 million dollars for its fiscal year ending Sept. 30, 2011, compared to $424 million for the previous fiscal year. “We achieved financial results equivalent to the pre-economic crisis levels of 2008 with improved sales in all our key regions, primarily driven by the machine tool, automotive, electronics, and medical device industries,” says Günther Braun, RSTI president and CEO. “We believe that our backlog and expanding product portfolio, especially in fiber lasers, provide us with a solid platform for a successful fiscal year 2012 in spite of the current challenging market conditions.”

Speaking of fiber lasers, “IPG delivered another quarter of record revenue and net income,” says IPG Photonics CEO Valentin Gapontsev of its 3Q for the period ending Sept. 30, 2011. “Third-quarter revenues grew by more than 62% year over year [to $129.1 million], with continued strength from high-power lasers for materials processing applications.”

In the instrumentation and R&D sector, Coherent also saw record sales in 2011, up more than 32% with net sales of nearly $803 million for its fiscal year ended Oct. 1, 2011, compared to $605 million in the previous fiscal year. “A solid fourth-quarter performance capped off a record-setting year for Coherent including all-time highs for sales, orders, operating income, and earnings per share,” says John Ambroseo, Coherent’s president and CEO. Although backlog for its fiscal 4Q was down to $356 million from $369 million in the previous quarter, Ambroseo continued, “While we have the usual puts and takes in various markets, the reduction in fourth-quarter bookings is almost entirely related to the timing of orders in the FPD [flat-panel display] market for annealing systems. We are working with a number of customers throughout Asia on adding new capacity for FPD production and we expect to receive meaningful orders in fiscal 2012.”

And while it’s true that credit and investment funds are still difficult to obtain for small and medium-sized laser firms, the largest companies have cash to acquire complementary laser technology. And let’s face it, the laser market is still maturing, products are reaching commodity status in many areas, and the consolidation trend we first reported in our 2009 Laser Marketplace summary will continue into 2012. In late 2010, Gooch & Housego (Ilminster, England) acquired Em4, and by summer 2011, Newport Corp. (Irvine, CA) had acquired High Q Technologies and Ophir Optronics; IDEX Corp. (Northbrook, IL) acquired CVI Melles Griot; and Halma (Amersham, England) acquired Avo Photonics.

In summary, the laser business—for companies both big and small—boomed in 2010 and 2011. But was the boom that big sound that sometimes accompanies a series of earthquakes? Only time will tell. For now, Laser Focus World would like to maintain its technology focus on the exciting laser applications and potential new markets that keep many of us involved in this business year after year.

More gadgets and 50 years of laser diodes

The semiconductor industry may be in a cyclical downward trend as evidenced by SEMI’s latest forecast calling for global fabrication equipment spending to fall 3% in 2012, but much of what fueled the outstanding rise of the semiconductor industry to an all-time high fab equipment spending level of $41 billion in 2011 was sales of “smart” electronic devices such as iPhones and iPads (and other tablets)—good news for the lasers that cut, mark, anneal, and pattern nearly all the components that these high-tech electronic gadgets comprise. As Karlsruhe Institute of Technology (KIT; Karlsruhe, Germany) professor Juerg Leuthold said in his “Hot Topics in Optics” presentation at Frontiers in Optics 2011 in San Jose, CA, “There are now more connected devices than people on the planet.”

The year 2012 also marks the 50th anniversary of the laser diode. “Alfalight is bullish about the future for diode lasers,” says Ron Bechtold, Alfalight (Madison, WI) VP of sales & marketing. “In military peace-keeping environments, new technology allows lasers to safely limit the risk of civilian injuries. One example is the use of a 330 mW green laser combined with a rangefinder for eye-safe engagement of individuals approaching checkpoints. In addition,” adds Bechtold, “Europe’s WWW.BRIGHTER.EU project and companies like TeraDiode and Laserline are making steady headway in improving direct-diode beam quality for materials processing applications.”

The days of the laser being a technology in search of an application have ended. More commonly, press releases regularly announce new capabilities that only laser technology can deliver. A recent example is the laser drilling of tiny holes in the Apple iPhone—holes so small that they are nearly invisible to the human eye, yet let green light shine through the aluminum housing of the iPhone just above the screen to indicate when the camera is on. It turns out that those tiny laser-drilled holes are also playing a role in improving LED performance: Gem Hsin Electronics (Taipei, Taiwan) is using laser-precision technology to drill extremely small holes beneath its LEDs, creating direct paths for heated air to escape to the heatsink, improving LED efficiency and lifespan. Like last year’s Kinect, you never know what new applications are just waiting to bolster laser sales!

THE MARKET SEGMENTS

Materials processing and excimer lithography

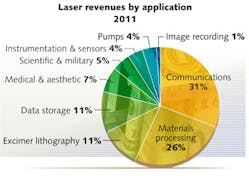

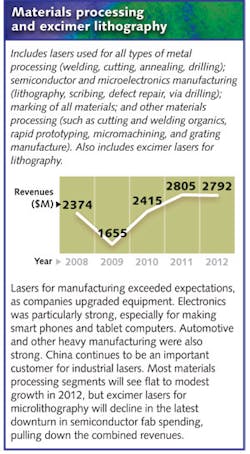

Uncertainty was a familiar word in 2011 that was used by economic analysts, businessmen, and the media to such a degree that by the end of the year it was a meaningless description of the attitudes of buyers in the laser system capital equipment market, which, despite yo-yo gyrations in the European economy, disastrous calamities in Japan, and a sudden reversal of a government-mandated slowdown in China, enjoyed continued strong double-digit growth after a remarkable and record-breaking comeback in 2010. All year long the industrial laser market in the US waited for the expected and predicted other “shoe”—a double-dip recession—to drop, which it never did. Instead, quarter after quarter, the three-dozen international companies that Industrial Laser Solutions tracks reported strong revenues and their forward-looking observations remained positive.

As 2011 came to a close it was obvious that the global manufacturing sector was countering conventional wisdom by racking up sales in all sectors of the economy led by seemingly recession-impervious markets such as aerospace, energy, transportation, medical devices, and fabricated metal products. A 38% growth in fiber laser systems sales led by the rapid, unanticipated surge in high-power units for sheet-metal cutting was a major contributor, even as the long-established CO2 laser sales also experienced 14% growth. And a 16% increase in sales of ultrafast-pulse solid-state lasers helped to revive moribund solid-state sales hit hard by growing acceptance of fiber lasers in the marking and microprocessing sectors.

Industrial laser revenues in 2011 came close to the magic $2 billion level showing a 19% increase over the previous year. Carbon-dioxide (14%), solid-state (4%), and fiber laser (48%) sales increases were joined by a 17% growth in sales of diode and excimer lasers (grouped in the “other materials processing” category). A modest forecasted 5% growth will vault industrial laser sales above $2 billion in 2012.

Laser system revenues in 2011 tracked laser numbers and are estimated to set a new high with a significant 16% increase over the previous year. A strong rebound in the sheet-metal-cutting market is the main contributor to this record-setting performance as both high-power CO2 and fiber lasers pushed unit sales up more than 15% over 2010. This market sector dominates system revenues with more than half the 2011 total.

Metal processing continues to lead laser application revenues at 68% of all units sold. This is followed by marking/engraving systems at 17% and microprocessing at 8%. Other applications grouped totals 7%. On a unit basis, marking /engraving accounts for 59% of all industrial lasers sold even though revenues do not top $332 million in 2011.

At least in the US, enthusiasm over the role of lasers for materials processing of solar photovoltaic (PV) cells was not helped by the Solyndra bankruptcy. But the solar industry is still growing, with solar installations in China recently matching demand levels currently seen within the US and worldwide tool capex reaching a record $13 billion in 2011 according to Solarbuzz (San Francisco, CA). “However, laser-based tools continue to struggle to gain any significant levels of widespread adoption in the industry, with limited signs of any collective technology roadmap being adopted by the leading PV manufacturers,” says Solarbuzz analyst Finlay Colville. “The pull from thin-film technologies for laser-based patterning tools has offered strong revenue opportunities for Asian-based laser-tool integrators, with thin-film turn-key production line growth coming primarily from domestic equipment suppliers in China and Korea.” Colville adds, “The 2011 market for laser-based tools used in the PV industry reached a record level of $340 million, with 70% coming from thin-film based laser tooling. But the overcapacity in the industry today is likely to prompt a capex downturn that may last into 2014.”

Industrial laser systems revenues have been on a roll since the recovery started in 2010. From a low of $4.6 billion in 2008 they have grown 53% to $7.1 billion in 2011, despite the extremely uncertain economic climate. Some industry suppliers, reading their tea leaves, are looking for a very modest growth in 2012, with a vocal minority predicting a flat year. Leading suppliers of high-priced laser cutting systems interviewed at the attendance-record-breaking Fabtech show held in November 2011 were for the most part very cautious in their 2012 projections, with only industry leader TRUMPF suggesting double-digit growth for 2012. Consequently the Industrial Laser Solutions 2012 forecast shows a 5% increase in laser revenues and a 4% increase in system sales.

Medical and aesthetic

The laser market for medical (ophthalmic, surgical) and aesthetic (wrinkle and hair removal, liposuction, skin resurfacing) applications continues to grow steadily, despite aesthetic laser sales unfavorably tracking GDP trends. Revenues in this segment are expected to reach $518 million in 2012, for 3.9% growth compared to 2011.

While solid-state lasers still comprise the lion’s share of the total laser revenues in the medical and aesthetic laser category, laser diodes garner 13% of the total and represent by far the largest number of units (hundreds of thousands of diodes compared with thousands of lamp-pumped solid-state lasers, for example, in 2011). New entrants such as femtosecond lasers are being researched by companies including Carl Zeiss Meditec (Dublin, CA), Abbott Medical Optics (AMO; Santa Ana, CA), and OptiMedica (Santa Clara, CA), to replace excimer lasers in both corneal incision and vision correction, and for cataract surgery, respectively, owing to reduced cavitation bubbles and thermal damage. And mid-infrared (mid-IR) lasers (primarily holmium:YAG) are finding new niches in surgery, dentistry, and dermatology.

In the laser aesthetics market, healthcare hedge-fund manager and Seeking Alpha contributor Paul Nouri says that now may be an excellent time for aesthetics industry consolidation. Because many of these laser aesthetics companies, including Cutera (Brisbane, CA), Cynosure (Westford, MA), Palomar (Burlington, MA), Solta (Hayward, CA), and Syneron (Yokneam, Israel), are not profitable—largely due to the huge amount of money spent on convincing doctors to use their technologies—but are sitting on a lot of cash, consolidation could help these companies to reduce overlapping management and R&D project duplication costs and improve profitability.

Upside in the aesthetics portion of the market could come from over-the-counter handheld wrinkle and hair removal products if they gain traction with consumers; however, substantial sales increases are unlikely unless costs (and corresponding consumer price levels) can be dramatically reduced: $395 for Tria Beauty’s (Dublin, CA) in-home hair removal system is probably not a wise purchase for the unemployed.

Scientific research and military

Laser sales into scientific research markets should be helped in the next few years by some large scientific projects such as the Extreme Light Infrastructure (ELI). Companies like Continuum (Santa Clara, CA) “have a hat in the ring” for the ELI project, says Curt Frederickson, Continuum VP of sales and marketing, who anticipates that the laser industry should see some serious money for this project between now and 2015. “It’s an election year, and we see scientific laser growth flat to slightly up,” says Frederickson, with the usual caution on European debt and China’s potential slowdown.

US government science funding for 2012 to the National Science Foundation (NSF) and the National Institute of Standards and Technology (NIST) grew modestly by $173 million and $33 million, respectively, to levels of $7 billion for the NSF and $751 million for NIST. Funding to the National Aeronautics and Space Administration (NASA) was cut $648 million to $17.8 billion compared to 2011 funding levels. Most notably for the photonics community, the James Webb Space Telescope (JWST)—with oversight measures added—will be funded in 2012.

An end to stimulus funding in the US for 2012 is another concern for the laser industry. “Part of the stimulus package introduced two years ago was a temporary change to the tax code know as Section 179,” says Ken Dzurko, general manager of SPI Lasers (Santa Clara, CA). “In 2010, this allowed businesses to claim 50% of new capital equipment spending as a tax deduction; in 2011, the program was further bolstered to allow 100% tax deduction on qualifying capital expenditures. The present climate in Washington looks to completely eliminate this deduction going forward.”

But Dzurko is optimistic. “Through the recession, we saw companies pause to reconsider their manufacturing equipment and process choices, and subsequently choose lasers—and in particular fiber lasers—as a means of emerging more competitive as a result of higher throughput, better yields, lower operating costs, and reduced downtime for maintenance and process setup. We’ve seen many traditionally nonlaser processes [such as plasma and waterjet cutting of metals] embrace fiber-laser-based processes.” Dzurko concludes, “I believe this to indicate a fundamental expansion of the addressable market for laser materials processing, not simply a market share change from one laser type to another.”

Colin Seaton, global VP of sales and marketing for Fianium (Southampton, England), echoes Dzurko’s enthusiasm. “We grew through the recession, finding new applications and customers for our supercontinuum and fiber lasers in scientific, medical, and industrial markets. The scientific market is almost a pure GDP play, going up and down with the economy. But smaller companies offer unique, targeted technologies—not commodity items, but critical components to complete a research experiment often with no second source.” Seaton concludes, “In line with reduced scientific budgets for 2012—we see reduced growth, but growth nonetheless.”

The R&D funding and investment picture is more positive in China and Europe. China overtook Japan in 2011 R&D funding at an estimated level of nearly $154 billion and now ranks second only to the US at $405 billion, and Mercom Capital (Austin, TX) estimates that Chinese banks lent $40 billion alone to Chinese solar companies over the past two years.

In 2011—the 25th anniversary year of the National Natural Science Foundation of China (NSFC)—an International Evaluation Committee (IEC) officially reviewed the NSFC funding process for the first time, in part to determine how well the Chinese government’s extensive efforts to boost the support of scientific research measure up to international standards. The report commended the NSFC’s peer-reviewed funding process, and revealed that R&D investment in China since 1987 has seen an average annual growth rate of 21.6%, with nearly 70% of that share in recent years coming from private enterprise.

Estimated 2011 R&D funding for Europe was nearly $277 billion—holding at around 1.7% of GDP compared to 1.4% for China and 2.7% for the US. Early 2011 R&D budget discussions for 2012 called for growth levels as high as 13%; however, the European sovereign debt crisis is forcing a review of R&D spending in light of the austerity measures being evaluated for certain at-risk EU countries like Greece and Italy. Fortunately, a European Union Parliament vote in October 2011 still called for a 10.35% increase in R&D funding.

According to the Stockholm International Peace Research Institute (SIPRI), worldwide military spending in 2010 alone was estimated at $1.63 trillion, or 2.6% of world GDP—a much higher percentage than most countries spend on R&D and a whopping increase of 50% compared to 2001 spending levels. But military spending is at the peak of a cycle, most notably in the US, and we anticipate worldwide military laser spending to increase just 3.6% to about $195 million in 2012 as many laser technology platforms transition from military to civilian applications as they have, for example, in the case of infrared countermeasure or IRCM systems.

Worldwide, our forecast for 2012 laser sales into scientific research and military markets is $419 million, representing 2.7% growth compared to 2011.

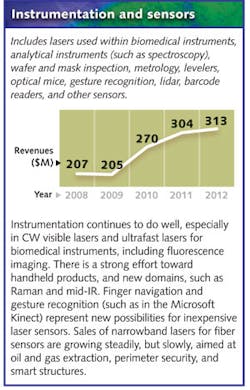

Instrumentation and sensors

Encompassing lasers for spectroscopy, diagnostic imaging, sensing, and biomedical instrumentation, the laser instrumentation and sensors market is forecast to grow in sales from $304 in 2011 to $313 in 2012. Analytical instrumentation companies like Bruker (Billerica, MA), who introduced the Innova-IRIS system in late 2011 that integrates atomic force microscopy with Raman spectroscopic imaging, saw healthy 35% revenue increases for 3Q11 (ending Sept. 30) compared to the same quarter in 2010. Bruker expects to continue double-digit growth in 2012 despite what its president and CEO Frank Laukien calls “a slowing macro environment next year.”

For the same 3Q period as Bruker, Bio-Rad (Hercules, CA) revenues were up 9.5% overall and up 11.9% in their Life Science segment, reflecting strong growth in their imaging instrumentation and Bio-Plex suspension array product, which analyzes up to 100 biomolecules in a single patient sample. Bio-Plex uses a liquid suspension array of 100 sets of 5.6 µm beads, each dyed with different ratios of two spectrally distinct fluorophores assigned a unique spectral address. The sets of beads are conjugated with a different capture molecule and react with specific analytes. Two lasers illuminate the beads, one exciting the dyes in each bead to identify its spectral address, the other exciting the reporter molecule associated with the bead to quantify the captured analyte. The fluorescence information is then analyzed with high-speed digital signal processors to identify the constituent proteins and peptides in a sample as small as 12 µl.

“A growing trend for life science applications is the need for multiple, yet discrete laser wavelengths for narrowband fluorescence excitation,” says Amr Khalil, product manager for lasers, laser optics, and mechanics at Edmund Optics (Barrington, NJ). “Broadband sources and filters are adequate for some applications, but the high powers needed to excite the particular wavelengths to match the commercially available fluorophores in medical research often require individual, higher-power laser sources.”

Good examples of multiwavelength, life-science-targeted sources are Coherent’s established CUBE and OBIS diode and optically pumped semiconductor laser (OPSL) platforms with modular units emitting in at least a dozen discrete wavelengths between 375 and 785 nm, and the Mobius Photonics (Mountain View, CA) Rainbow source with outputs switchable between individual wavelengths at 557, 571, 585, 600, and 616 nm to target particular fluorescent markers.

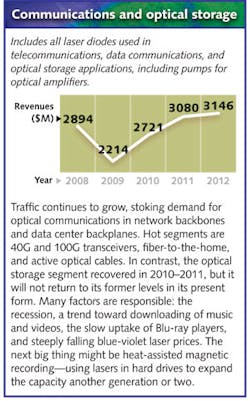

Communications and optical storage

“Challenging economic times may cause telecom providers to consider holding off on some investments to their optical networks, but rapid growth in bandwidth demand is here to stay,” says Sinclair Vass, JDSU (Milpitas, CA) senior director of marketing. “Providers will need to upgrade capacity in order to keep pace with the popularity of multimedia and video-rich applications used by consumers. This will continue to drive long-term growth opportunities for optical component vendors like JDSU.” In 2011, laser sales into communications and optical storage applications grew to $2.26 billion and $0.82 billion, respectively, for combined sales of $3.08 billion. Sales are expected to rise to $3.15 billion in 2012 as telecom markets return to long-term growth rates of 6–10% and optical storage, at least for now, continues its decline.

The decline in optical data storage revenues for CD, DVD, and Blu-ray disc lasers after 2012 reflects falling prices, market maturity, and the uptake of flash memory and Internet-based or “cloud” data storage; however, revenues for 780 or 870 nm laser diodes could increase if heat-assisted magnetic recording (HAMR) technology takes hold. Seagate (Cupertino, CA) favors HAMR—in simple terms, using laser diodes to heat the drive material and alter its chemistry to enable higher-capacity storage—while Hitachi GST (San Jose, CA) favors alternative non-laser-based patterned media to achieve storage levels of 50 terabits per square inch.

In an EE Times article, International Disk Drive and Materials Association (IDEMA; San Jose, CA) chairman Mark Geenen said of the HAMR/patterned media debate, “… the big shift appears to be a consensus on heat assisted being first and in the future moving to bit patterning …” The article said that in early 2011, the two sides in the road-map debate quietly converged on HAMR as their next step. But Keenen added, “… mainstream [HAMR] products won’t ship until 2014 or 2015.”

For the laser communications markets, traffic growth continues to drive demand, but unit sales and performance are growing faster than the non-GAAP revenues and profits that go to component vendors; both net and operating profit margins are small and even negative for many suppliers. Finisar (Sunnyvale, CA) revenues grew 5.8% to $241.5 million for the quarter ended Oct. 30, 2011 compared to the previous quarter, but non-GAAP operating margin fell to 9.8% from 17.0% in the same quarter of 2010 (with comparable revenue); Oplink and OpNext (both in Fremont, CA) revenues for the period ended Sept. 30, 2011 were down slightly to $43.4 million and $86.0 million, respectively, with net income at just $3.1 million (7.1% of revenues) and adjusted EBITDA of only $0.1 million; and Oclaro (San Jose, CA) revenues for the period ended Oct. 1, 2011 were also down slightly to $105.8 million compared to $109.2 million for the previous quarter (and largely impacted by the floods in Thailand), while operating loss was $9.6 million or 9% of revenues. JDSU fared a little better in non-GAAP operating margin at 10.9% although net revenues declined to $421.1 million for the quarter ended Oct. 1, 2011 compared to $472.3 million for the previous quarter.

Communications laser suppliers are hopeful that components for high-speed 100 Gbit/s and coherent communications schemes that command higher prices will improve both revenues and profitability in 2012. One thing is certain; such 2011 milestones as 100 Tbit/s fiber transmission and the 1 Tbit/s photonic integrated circuit (PIC) from Infinera (Sunnyvale, CA) illustrate that the thirst for high-speed, high-bandwidth optical communications shows no signs of subsiding.

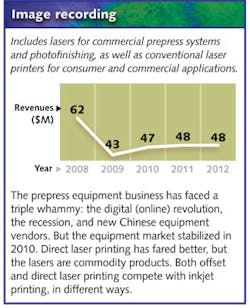

Image recording

With commercial release imminent, a new handheld laser-enabled inkjet printing device called PrintBrush—invented by Swedish engineer Alex Breton and reportedly taking 11 years and $10 million dollars to develop—is simply swiped across a sheet of paper, delivering the printed image. Mouse-like IR laser diode sensors track the printer’s movement and pinpoint its position (both velocity and direction of motion) by measuring the scatter and power fluctuations of the reflected beams. The ability to navigate across the paper using photonics eliminates the age-old condition that a printer could never be narrower than its paper.

Beyond this new laser application, RGB lasers—typically DPSS with 473 and 532 nm for blue and green, respectively, from companies like Cobolt (Solna, Sweden)—are still being used in laser recorders for digital photofinishing to print digitally stored images on photographic paper, and in laser scanners to transfer film images to digital format. “In the last few years, a major evolution of the global printing market shows continuous shrinking of the traditional offset market [globally -15%] and strong growth of new digital printing methods like inkjet [+15%] or Xerography [+14%],” says Guido Hennig, head of R&D laser engraving technology at Daetwyler Graphics AG (Bleienbach, Switzerland).

Although traditional printing markets are suffering in some areas due to evolving digital media and the Internet, Hennig says that new laser applications are developing as a result of this digital revolution. “Today’s digital printing methods like inkjet or Xerography require mostly expensive special inks or special substrate materials and consumables that dominate the costs of printing and stress the environment. A direct-writing process under development at Daetwyler called laser-induced backward transfer of ink (LIBT) enables digital printers to work with normal, inexpensive inks commonly used in today’s rotogravure processes.” Hennig adds, “Moreover, water-based ‘green’ inks or dry (solvent free) inks are suited for the LIBT process, and won’t stress the environment with harsh solvents.”

Revenues for lasers in the image recording industry reached $48 million in 2011 and are forecast to stay flat for 2012.

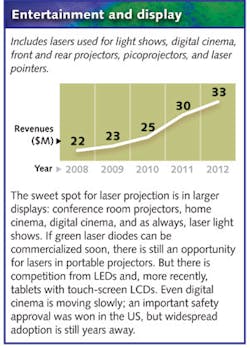

Entertainment and displays

Consumers have fallen in love with their media tablets: According to InfoTrends (Weymouth, MA), worldwide tablet shipments will grow at a compound annual rate of nearly 60%, increasing from 17 million units in 2010 to more than 175 million units in 2015. This proliferation of electronic displays is not just a personal obsession; digital signage is popping up in department stores and restaurants, giving customers new, interactive ways to review merchandise and order goods and services.

Emerging laser-based offerings that will benefit from the growing digital signage trend include Casio’s (Tokyo, Japan) LASER & LED HYBRID light engine for projection applications and Prysm’s (San Jose, CA) low-power-consumption Laser Phosphor Display (LPD) technology, which is interactively welcoming customers with Twitter messages as part of Lady Gaga’s 2011/2012 holiday window display at Barney’s Madison Avenue, New York flagship store—good news for all the “Little Monsters” out there.

In the entertainment industry, lasers continue to dazzle. At the 2011 MTV Video Music Awards, YLS Entertainment (Los Alamitos, CA) used four 12 W green Nd:YAG lasers controlled by Pangolin’s (Orlando, FL) LD2000 laser system to accompany the performance of Miami rapper Pitbull. YLS also used six KVANT laser projectors—0.5 W of green DPSS laser power in each—to enhance the performance of Enrique Iglesias at the 2011 American Music Awards.

In 2011, sales of lasers used in entertainment and displays reached $30.4 million. Growth of 9% will take sales to $33.0 million for 2012.

Pump and other lasers

Lasers used to pump DPSS and fiber lasers will account for $297 million in sales for 2012. While sales numbers have historically been larger for DPSS pump lasers, sales for fiber laser pumps will surpass DPSS pumps by 2014 and continue to gain a larger share of the pump laser market.

For more in-depth analysis

Much more detail on the laser markets is available from Strategies Unlimited in its recent report, “Worldwide Market for Lasers 2012” (www.strategies-u.com). Details include forecasts to 2015 of units, average prices, and revenues by segment; estimates of market share; and discussion of the dynamics within each laser segment. The report is the only comprehensive report on the laser market, and the tenth in a series that includes fiber lasers and industrial lasers. Special topics reports in the series cover mid-IR lasers and ultrafast lasers.

About the numbers

The estimates and forecasts of laser shipments were based on both supply and demand side analyses by Strategies Unlimited (www.strategies-u.com), a PennWell business. Strategies Unlimited has been conducting market research in photonics products for more than 30 years, with specialties in lasers and high-brightness LEDs.

The analyses used information gathered from interviews conducted throughout the year by Laser Focus World and Industrial Laser Solutions, as well as from financial statements and news reports. The demand side analysis focused on the relevant trends in 2011 and in recent years for sales of laser-based systems and the buying trends of customers of those systems. The supply side analysis focused on the corresponding trends of suppliers of lasers and their suppliers. The effort considered both quarterly trends and long-term historical trends; results were then compared and adjusted to correct for known errors.

The Laser Focus World quantitative market survey remains the only comprehensive market survey of the laser industry. More information will be available from Strategies Unlimited and at the Lasers & Photonics Marketplace Seminar (www.marketplaceseminar.com) held in conjunction with Photonics West in San Francisco on Monday, Jan. 23, 2012.

The Laser Focus World annual review and forecast of the laser marketplace is conducted in conjunction with Strategies Unlimited (Mountain View, CA; a PennWell company) with additional input from Industrial Laser Solutions.

More Laser Focus World Current Issue Articles

More Laser Focus World Archives Issue Articles