LASER MARKETPLACE 2007: Laser industry navigates its way back to profitability

There’s nothing quite like taking a calculated risk-marrying instinct with intellect-and watching it pay off. Whether in business, investment, R&D, sports, or life, we surround ourselves with the right tools, data, and people to ensure an optimal return. Even so, at the end of the day, it’s all still a bit of a gamble. For the last five years this industry has worked hard to strike the right balance between the “sure thing” and the “next big thing”-and this focused effort appears to be yielding some positive returns. After a lackluster 2005, the worldwide laser business experienced a surprisingly strong 2006-thanks in large part to better-than-expected performance by the semiconductor industry and to the continuing rebound of optical communications, among other factors. Looking forward, the industry’s mood seems to be one of optimism tempered by concern centered around the level of investment in the semiconductor arena for 2007 and general wariness related to economic conditions.

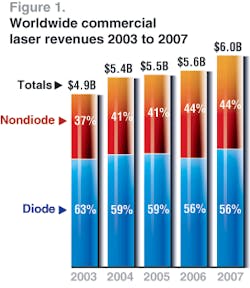

At first glance the results of our survey might appear to contradict this scenario. Global revenue growth for all lasers for 2006 over 2005 was just 2%. However, a look at the underlying detail reveals that nondiode laser sales actually gained 11% for this period and that positive unit growth for diode lasers into 2006 was in fact offset by average price declines-producing a revenue change of -4%. For 2007, we expect a global revenue increase of 8% for all lasers with total sales exceeding $6 billion for the first time (see Fig. 1). We should note too that (because we report revenue in current U.S. dollars) price changes can result from exchange-rate fluctuations that occur during the year . . . and in fact some of the diode-laser revenue decline results from the decline in the value of the yen against the dollar. At the same time, though, the U.S. dollar is currently at a 20-month low against the euro, creating the opposite effect for lasers manufactured in Euro-zone countries.

Laser Focus World is not alone in its outlook. A report from the Optoelectronics Industry Development Association (OIDA; Washington, D.C.), released at the end of 2006, found that total sales of optoelectronics components and enabled products grew 20% in 2005 to $364 billion, up from $304 billion in 2004. The driving force behind this increase continues to be the successful penetration of display-based products and technologies into the consumer and computer markets, OIDA noted, with much of the growth in the components segment being driven by solar cells (24%), display modules (20%), and sources and detectors (10%).

“Telecom and datacom markets have strengthened in 2006, but the real excitement is that optoelectronics components are beginning to be utilized in high-volume consumer, entertainment, and computing-based products,” said Michael Lebby, president and CEO of OIDA.

The big picture

Continuing what is now becoming a long-term trend, a growing proportion of laser and optoelectronics revenue growth is tied, directly or indirectly, to consumer spending. As a result, the industry is affected more than ever by macro-economic factors such as interest rates, foreign-exchange rates, trade imbalances, oil prices, the conflict in Iraq, and consumer confidence.

In the first three quarters of 2006 the U.S. gross domestic product was best described as weak, due in large part to one of the largest declines in residential investments (both construction and real-estate transactions) in the United States since 2001. At the same time, however, real disposable income rose 3.7% in the third quarter, following an increase of 1.7% in the second quarter. The other good news is that the budget deficit, which at the beginning of 2006 was expected to top $400 billion, looks to have decreased instead, settling in at about $250 billion for the year. The end result is that while inflation is still a concern in the United States (the core inflation rate rose 2.4% between November 2005 and November 2006, up from 2% for the same period the year before), it is not to the extent that analysts see a long-term negative impact on consumer spending.

“It is encouraging that the recent weakness in residential construction does not appear to have spilled over to other sectors,” said Susan Bies of the Board of Governors of the Federal Reserve System in a lecture on Nov. 2, 2006. “Employment has been growing smartly in nonresidential construction, even as it has shrunk in the residential sector. In addition, consumer confidence currently stands a bit above its long-run average and consumption is still being fueled by past house-price gains, which raised household wealth. This contrasts with previous slowdowns in the housing market, which have typically coincided with widespread economic weakness.”

Bies noted, however, that although the slowdown in the housing market has so far done little to reduce consumer outlays, other factors do appear to have had a damping effect. In particular, consumption was restrained in 2006 by the rise in energy prices, which took a large bite out of household budgets, she added. Even so, Bies concluded, “The picture painted here is one of an economy (U.S.) that has been growing solidly, albeit at a rate below its potential.”

Another factor behind consumer confidence is corporate confidence-whether in terms of jobs, stocks, housing prices, or willingness to invest. In 2006, lasers and photonics benefited from the emergence of new types of financing, plus a return to what was just a few years ago a staple of this industry: the initial public offering (IPO).

“The choices of how you finance a company are broadening in a variety of ways that didn’t exist even three years ago,” said John Dexheimer, partner at First Analysis Private Equity and president of LightWave Advisors. “The industry has cleaned itself up post-telecom, and as the demand side, diversity, and maturity of technologies have improved, so have the financing alternatives.”

Several optics, laser, and related companies-including IPG, QPC Laser, Optium, Arasor, Opnext, Enablence Technologies, and Cynosure-went public in 2006 (QPC and Enablence through reverse mergers, the others via IPOs), and there is a growing trend to find new sources of capital from international investors, including looking outside the United States to avoid the additional costs associated with the Sarbanes-Oxley Act. According to some analysts, Sarbanes-Oxley has single-handedly ground down the pace of development for young technology companies by saddling them with an endless stream of bureaucratic costs-on the order of $5 million initially and $3 million annually.

“This pushes the whole cost of listing into the $100 million range, so unless you are in the $150 million range as a company, it’s not worth it,” noted Larry Marshall, cochairman of Arasor (Mountain View, CA), which filed its IPO in Australia last October.

Venture capitalists are also exhibiting renewed enthusiasm for optics- and photonics-related ventures, according to Steve Eglash, principal at Worldview Technology Partners (Palo Alto, CA). Areas of particular interest for venture capitalists include sources for illumination, biotech, and semiconductor applications; fiber lasers for industrial applications; displays; photovoltaics; video eyewear; sensors; and detectors.

“In 2005, venture-capital investment in photonics was up about 17% compared to 2004,” Eglash said. “That trend continued in the first half of 2006 and may have even accelerated.”

Generally speaking, while smaller and mid-size companies are gaining traction in the financial community, a handful of larger public companies still dominate the laser and optoelectronics landscape, and in fact serve as financial bellwethers for the industry overall. Coherent (Santa Clara, CA), for example, reported revenues of $585 million for FY2006 (ended Sept. 30), up from $516 million in FY2005. Much of this growth was attributed to the microelectronics market, where the company recorded sales of $219.2 million for FY2006, up from $177.4 million in FY2005. John Ambroseo, president and CEO of Coherent, told analysts on Nov. 1, 2006, that the key to the company’s financial story throughout FY2006 was continued strength in semiconductor capital expenditures, flat-panel display, and packaging applications.

“In the semiconductor arena, demand for lasers used in 300 mm photomask processes, wafer inspection, and metrology remained robust,” he said. “Of particular note was customer investment in 45-nm-node process-control development, where our lasers play a key role.”

Earlier in 2006, Ambroseo pointed to increased activity in the microelectronics sector back end, particularly applications surrounding printed-circuit boards and chip packaging.

“The types of consumer electronic devices going out these days, such as the 3.5 G cell phone, are much more densely packed with functionality, which leads to more complex architectures, and this is where laser processes really shine,” he said.

Similarly, Newport (Irvine, CA) saw its revenues increase 10% throughout much of 2006-thanks in large part to the semiconductor and microelectronics markets. The company’s revenues for the first three quarters of FY2006 (ended Sept. 30) were $330 million, compared to $300 million for the same nine-month period in FY2005. Looking ahead, Newport anticipates additional growth in photovoltaics, basic research, and health and life sciences, according to Arnd Krueger, director of marketing for the Spectra-Physics division of Newport.

“On the laser side we are faring quite well in terms of growth-in fact, it is significant compared to last year,” he said. “Much of that is due to the semiconductor market. While there is some concern [about this market] for 2007, we are working with our customers on some new products; when a down cycle comes, it usually affects existing tools, and our customers use these down cycles to position themselves with new tools.”

World markets stronger

Outside North America the picture is mixed, but several geographic markets are showing signs of renewed strength. According to Manfred Augustin, who took over as head of Laser 2000 (Munich, Germany) in late 2006, the telecom market has rebounded in much of Europe, particularly in Germany, Benelux, the U.K., and Italy. Laser 2000-the largest European distributor of lasers and optoelectronic components-is also seeing increased growth in Spain and several Eastern European countries, including Hungary, Poland, Slovakian Republic, and Czech Republic-again, particularly in the optical-telecom sector. From a product sales perspective, other strong markets in Europe include biomedical instrumentation, materials processing, graphic arts, consumer electronics, displays, and medical diagnostics and therapeutics.

“We have seen substantial growth in the European market overall, particularly in optoelectronics-on the order of 12% to 15%, and for some companies even more,” Augustin said.

Trumpf (Ditzingen, Germany), for instance, reported record sales of €1.65 billion (US$2.1 billion) for FY2005/2006 (ended June 30, 2006), up 18% over the previous year. The company attributed the bulk of its growth to a 23% increase in its machine-tool business for sheet-metal processing, with the strongest gains coming in Eastern Europe, America, and the Pacific Rim. Sales of the Laser Technology/Electronics Division gained 8.5% to €438 million (US$561 million).

Rofin-Sinar (Hamburg, Germany) reported a 12% increase in revenues for 2006 (ended September 30) over 2005, with net sales totaling $420.9 million, although the strengthening of the U.S. dollar against the euro had an $8.8 million negative impact. Net sales in North America totaled $126.5 million, up 16% over 2005, while net sales in Europe/Asia increased 10% to $294.4 million. According to Peter Wirth, executive chairman of the board, Rofin-Sinar continues to concentrate on developing special laser models for dedicated applications to serve high growth industries, such as medical devices and electronics industries.

It is interesting to note that the political and economic landscape in Europe has changed radically over the past few years and will continue to do so as Eastern European countries gain membership of the European Union (EU) creating much enlarged “home” markets for EU producers, while opportunities for expansion arise from cheaper labor pools and lower-cost manufacturing sites.

As a result, in 2006 several laser and optoelectronics ventures crossed into new territory. Trumpf opened a new manufacturing facility in Liberec in the Czech Republic, along with a new Russian subsidiary. Siemens VDO Automotive took over Infineon’s manufacturing facility in Trutnov in the Czech Republic, when Infineon exited the fiber-optics business. 3M continued to invest in Poland, announcing plans to build an LCD optical-film manufacturing facility in Wroclaw near its existing manufacturing operation. Sharp is also negotiating with the Polish government to build an LCD manufacturing facility in Torun. The factory will supply LCD modules for large screen TVs. Schott has begun operating the first of nine new melting tanks for use in manufacturing glass tubes for the backlighting of monitors in Valasské Mezirící, Czech Republic. The Jenoptik Group’s new production site for lasers and laser components is now operational in St Petersburg, Russia. Lasers produced at the plant will be sent to Jena for integration into components and systems for civil and military applications.

Meanwhile, alliances and manufacturing opportunities in Asia are still attractive to European companies. In 2006 Dutch consumer electronics giant Philips merged its mobile display system business unit with Taiwanese firm Toppoly to create a joint venture, TPO, giving Philips access to high-volume production facilities in Taiwan and China for advanced mobile-display technologies such as low-temperature polysilicon and active-matrix OLEDs. French liquid-lens pioneer Varioptic announced that it would build the world’s first mass production line for liquid lenses with Creative Sensor of Taiwan. The production line will be installed at Creative Sensor’s manufacturing site in Wuxi, China. Meanwhile the move of Bookham’s test and assembly operations to its site in Shenzhen, China, has led to the sale of the company’s facility in Paignton, England, to an unnamed buyer.

Overall, the Asian market continues to represent great potential for lasers and photonics. While China is still considered more of a producer than consumer-with the exception of a growing optical-network infrastructure based on wireless technologies-Japan has re-emerged as a noteworthy market for lasers, particularly in fiber-to-the-home applications and medical and industrial systems.

“For Newport/Spectra-Physics, Asia is faring quite well,” Krueger said. “China is doing well in the research market, where we are seeing some success with diodes and Q-switched lasers, although it usually is very price-competitive. But overall we have done very well in the Pacific Rim, not just Japan but Taiwan, Singapore, and Korea especially-and that is for all lasers, not just research.”

At the same time, however, some analysts are concerned that China’s big banks have overextended themselves with too many loans for political or social reasons rather than commercially sound ones.1 While the government has sought to ease the problem by spending $400 billion since 1998 to cover bad loans for real estate projects or to state-owned enterprises, fears remain that Chinese banks are still burdened with many more troubled loans than they will admit. Even so, some of the world’s largest financial institutions are investing in these banks; Bank of America, Goldman Sachs, Royal Bank of Scotland, UBS, Merrill Lynch, HSBC, and American Express have all bought minority stakes in Chinese banks ahead of planned IPOs, and so far these investments appear to be smart ones. The Bank of China, for example, raised $11.2 billion in an IPO in mid-2006, and in October the Industrial and Commercial Bank of China, the country’s largest bank, sold a 16% stake, raising $22 billion.

The markets and the numbers

Aside from the various forces at play in the markets, there are also important shifts occurring in the technologies-most notably the ongoing displacement of nondiode lasers by diode lasers for many applications, from medical therapy to the graphic arts. Growth of solid-state lasers continues, driven in part by continuing improvements to the semiconductor pump lasers. And although views are mixed as to the broad-scale market potential at this point, fiber lasers (which grew 55% in revenue from 2005 to 2006) continue to challenge established markets, especially for industrial applications in which most sales are not into new applications but into applications previously served by other lasers. Fiber-laser maker SPI (Southampton, England) says it has seen 100% product growth and 175% contract revenue growth in the past 12 months and expects this trend to continue into 2007 and beyond, according to Stuart Woods of SPI. The company is primarily focused on microelectronics and marking but is also expanding into the medical arena and expects this market to yield additional strong revenues.

“We are spending a lot of time looking at new applications that are not being touched yet by fiber lasers, and this is where a lot of our new accounts are coming from,” Woods said. “So these numbers can reflect the actual growth of this market.”

As we noted last year, the application groupings or market segments we use are intended to make manageable a complex and interlocking picture of laser technologies and applications. Because of the complexity, the following discussion presents a necessarily brief look at some of the key segments from this year’s market review and forecast.

Materials processing

Growth in semiconductor manufacturing generally bodes well for the optoelectronics business. Industry association SEMI (San Jose, CA) predicted mid-year that, following an 11% decline in 2005, semiconductor capital equipment spending would increase 18% to $39 billion in 2006. While the market is expected to be flat in 2007, double-digit growth should resume in 2008, topping $44 billion, according to SEMI.

Similarly, the Semiconductor Industry Association (SIA; San Jose, CA) reported that sales of semiconductors reached an all-time monthly record of $20.5 billion in August 2006, a 10.5% increase over August 2005. According to SIA President George Scalise, sales growth was led by DRAMs (memory), which increased by 7.5% from July and by 31.4% from August 2005, an indication that PC sales remained healthy. In addition, capacity utilization remains high, dipping slightly to 92% in mid-2006 but returning to 95% through the last quarter of 2006, according to VLSI Research (Santa Clara, CA).

“Semiconductor devices for consumer applications-NAND flash and consumer application-specific semiconductors-showed strong sequential growth, as manufacturers began gearing up for the holiday season,” Scalise said. “A sharp decline in gasoline prices appears to have boosted consumer confidence, which bodes well for an industry that is now strongly driven by sales of consumer electronic products.”

Perhaps even more important is the general consensus that the cyclicality of the semiconductor business has evened out somewhat, with more stable and consistent growth over longer periods of time. In 2006, semiconductor manufacturing was once again a primary driver behind growth in the laser and optoelectronics industry with sales of lasers for these applications jumping 34%. Looking ahead to 2007, however, the view is still cautious.

“In the immediate future, we believe chipmakers will continue to order equipment in line with expected demand,” said Bob Akins, president and CEO of Cymer (San Diego, CA), when the company released record earnings results of $144 million for the third quarter of FY2006 (ended Sept. 30), a 44% increase over the third quarter of FY2005. “Light-source demand will be modulated by a variety of factors, including under- or overcapacity in individual chip sectors, rate of shrinking chip designs at individual chipmakers, and our direct customers’ manufacturing capacity for new model lithography tools.”

Akins noted that the company had shipped a relatively large number of its newer argon fluoride (ArF) sources but had only installed about half of them. As a result, Cymer expected demand for these lasers to drop off through the end of 2006 but bounce back in the first half of 2007.

“Looking beyond the fourth quarter, as these light sources are absorbed and our customers’ new manufacturing capacity is realized, we anticipate a resumption of the shipment rate . . . up to the third-quarter level in the first quarter of 2007,” he said.

Meanwhile, sales of lasers for materials-processing applications are doing better than expected, according to David Belforte, editor in chief of Industrial Laser Solutions. A year ago the industry projected an overall 4% growth in units and revenues for lasers and an 8% growth in systems revenues, he says. It turns out that industrial laser unit sales increased by 7% over 2005, led by vigorous growth in low-power CO2 lasers and strong sales of fiber lasers, which continue to erode the markets for lamp- and diode-pumped solid-state lasers. A small, but welcome, addition to 2006 solid-state laser sales was contributed by the suppliers of ultrafast lasers for microprocessing applications. These sales are seen as a precursor to the long-awaited penetration of these lasers into the semiconductor processing market.

A significant addition to unit sales growth was the continued health of the fabricated sheet-metal-products market, which globally purchased about 9% more high-power (and consequently higher selling price) CO2 lasers, especially those at the 6 kW power level. A second year of strength in the domestic market for these lasers in Japan (up 14% over 2005 domestic sales) also helped to push unit sales growth.

Laser marking remains a major market in terms of units sold and showed strong double-digit growth in 2006-a situation expected to continue for some years, driven by security and traceability requirements, says Belforte.

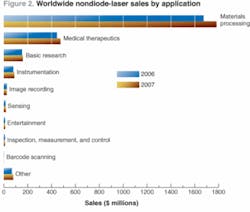

Overall sales of lasers for all materials-processing applications reached $1.7 billion in 2006-an 11% gain over 2005-with unit sales remaining essentially flat. Next year is expected to see growth of around 7% for this sector.

Medical therapy

Nondiode-laser sales in this segment were up 13% in 2006 to reach $445 million with another 7% growth forecast in 2007. Cosmetic applications again dominate, a trend not expected to change any time soon. While diode-laser hair removal still represents the largest application in this market, skin rejuvenation saw a resurgence of sorts, although that is not all good news for the laser companies, given that a number of competing technologies (nonlaser) have made their way into the marketplace.

At the 2006 meeting of the American Society for Laser Medicine and Surgery, for example, hair removal was not the hottest topic; rather, the various approaches to wrinkle removal and skin rejuvenation-which include lasers (fractional and otherwise), intense pulsed light (IPL), radio frequency, plasma, and various combinations thereof-were what the crowd of physicians and nurses seemed most interested in. The general consensus is that while the ability to use lasers (primarily erbium and CO2), ILP, and other sources to treat facial wrinkles and wrinkles of the neck and hands is exciting and continues to be a growing business for these surgeons, there is also much confusion over which approach is “best.” Some physicians noted that there is too much competition and too much hype, which makes it difficult for them to know what equipment to invest in. Other concerns include treatment times and a need for a better way to treat deep wrinkles.

Another surprise in the medical-laser field in 2006 was the downturn in laser vision correction, which impacted excimer-laser sales for ophthalmology. Two of the major players in this market-Bausch & Lomb and Alcon-reported lower-than-expected revenues from their refractive-surgery businesses, and VISX revenues declined steadily quarter over quarter during 2006, although the company overall beat revenue estimates for the year by $25 million.

One exception was IntraLase (Irvine, CA), which reported $130 million in revenues for FY2006-$40 million more than most analysts expected. The company’s diode-pumped Nd:YAG femtosecond laser systems (Intralase manufactures the 1053 nm sources itself) continue to find favor in Europe and other world markets for LASIK and are catching on in North America as well. Following the annual American Academy of Ophthalmology meeting in Las Vegas last November, one analyst noted that the IntraLase-enabled keratoplasty approach is “trending toward becoming the standard of care for cutting the flap in LASIK.”

Another medical-laser success story is Reliant Technologies (Palo Alto, CA), whose fiber-laser systems have taken the skin-rejuvenation market by storm. Reliant’s Fraxel SR aesthetic-laser system-which has FDA clearance for many protocols and clearance pending for treatment of acne scars and surgical scars-utilizes a 30 W erbium-fiber laser (from IPG) operating at 1550 nm that works in conjunction with Reliant’s proprietary scanning system to achieve precise resurfacing and remodeling of the skin while minimizing the collateral thermal damage. The system has generated much enthusiasm in the medical community, which has translated into significant sales for Reliant and accounts for much of the upswing in erbium-laser sales in this market in 2006.

Basic research

The scientific market for lasers has historically been something of a proving ground for high-end laser systems operating at performance extremes where high powers and fast pulses were often more important than cost and reliability. As photonics enabled research has evolved into new areas like biology, reliability and ease of use have become increasingly important to researchers who know little about the inner workings of the laser source. At the same time the complexity of the systems has generally increased pushing average pricing up as unit sales have fallen.

At $153 million in revenues for 2006, this segment continues to represent the number three market for nondiode lasers in terms of revenues-a position it has held consistently for many years despite a longstanding fairly lackluster year-on-year growth (typically around 7%). For 2006, revenue growth was 3%, while units fell 7%, and for 2007 sales are projected to move up 5%.

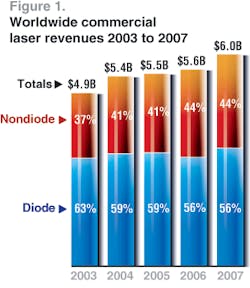

Instrumentation

Traditional chemical analysis remains a solid industry, but life-science research continues to be the source of most of the sales activity in laser-based instrumentation, according to Michael Tice, vice president of Strategic Directions International (Los Angeles, CA) and contributing editor of Instrument Business Outlook, published by SDi. While 488 nm solid-state lasers have gained some traction in this sector over the last three years (particularly for flow cytometry and confocal microscopy), there are still hurdles to overcome, according to several laser suppliers-notably, getting the larger instrumentation OEMs to make a full transition from argon-ion lasers to the more-expensive (at this point) solid-state lasers (see “Next-generation cytometers think outside the box,” page 121).

Even so, the market for biomedical instrumentation once again saw growth in 2006-due in part to the adoption of a range of solid-state lasers and the continued need for replacement gas lasers in installed legacy equipment. At $79 million, nondiode laser sales for 2006 were up 7% over 2005-all the more significant given that sales into the nonbiomedical sector actually fell.

Raman spectroscopy remains one of the most active areas of molecular spectroscopy. For spectroscopic applications, the Raman signal, which is typically weak, can be augmented through the use of special materials that are brought into contact with the sample. Although this process is generally carried out through the use of metallic substrates in surface-enhanced Raman scattering (SERS; see www.laserfocusworld.com/articles/274732), makers of atomic-force microscopes have applied these materials to the AFM tip, resulting in tip-enhanced Raman (TERS). Both SERS and TERS-which typically utilize diode and other lasers in the 532 to 1064 nm range-have the potential for single-molecule detection, something of a “holy grail” in life-science research that could lead to effective security devices for detecting and identifying pathogens and other dangers.

Traditional fluorescence instrumentation is a more mature market than Raman, but even here certain developments are leading to growth. Foremost among these is Fluorescence (or Förster) Resonance Energy Transfer (FRET), which involves the energy transfer between two molecules (typically both fluorescent) that is mediated by a dipole-dipole interaction. After laser excitation of the donor molecule, the accepter molecule will fluoresce if the two molecules are closely bound. Measuring the fluoresced signal allows researchers to determine the binding and kinetics of molecular interactions.

Although FRET imaging depends on lasers, other future applications of fluorescence may not rely as crucially on lasers. Quantum dots act as fluorescent tags and can be excited by broadband sources, rather than lasers. Quantum dots have not been used extensively in life-science research because of toxicity-most are based on toxic metals. However, in May of 2006, researchers at Clemson University demonstrated a carbon-based quantum dot.2 While it will take some time for the use of biologically safe carbon dots to become widespread for biomedical and medical research, this trend may exert a braking effect on the use of lasers for fluorescence applications.

A more positive development can be found in in vivo laboratory animal imaging. Although many imaging systems used for life-science research with animals are scaled-down versions of medical scanning technologies (PET, CT, and so on), one of the fastest-growing segments is optical imaging. VisEn Medical (Woburn, MA) has introduced an optical-imaging system based on fluorescence molecular tomography, which uses near-IR diode lasers to excite fluorescent markers in the animal. Similar systems are sold by CRi (Woburn, MA), ART (Saint-Laurent, Canada), and Xenogen, which was acquired early last year by Caliper Life Sciences (Hopkinton, MA). In these systems, lasers can be used for either stimulating fluorescence or scanning the external topography of the animal.

Image recording

For nondiode lasers, the bulk of lasers sold for image recording has historically been in “prepress” applications-an area that has matured to the point where the traditional gas lasers that once defined this market have been almost completely displaced by solid-state or diode lasers.

According to Dan Gelbart, former chief technology officer at CREO and now senior research fellow at Kodak (Rochester, NY), which acquired CREO in 2005, in terms of significant dollar volume the graphic arts industry today buys only two types of lasers-multimode laser-diode bars and blue laser diodes. Kodak, for example-which holds a 40% share of the prepress market, according to Gelbart-purchases around 10,000 diode bars each year and 5000 blue diodes each year.

“It used to be blue argon lasers, but that market was gone a long time ago,” he said. “There is some limited use of diode-pumped Nd:YAG and CO2 lasers (primarily for flexo engraving), but the total market for these lasers is less than 100 units per year and probably more like 25 to 50 per year.”

Other segments of the image-recording segment, such as photofinishing and printed-circuit-board imaging, remain as nondiode-laser users, however. So the overall “image recording” picture is somewhat mixed. For instance, Coherent reported a 79% decline in revenues from its graphic-arts business in FY2006 (attributed partly to market conditions and partly to price erosion in a competitive market); and at the same time, the company noted growth in the market for direct imaging of PCBs. The net result of all this, for nondiode lasers in 2006, was a 10% decline in revenues from 2005, with a further 3% decline expected in 2007.

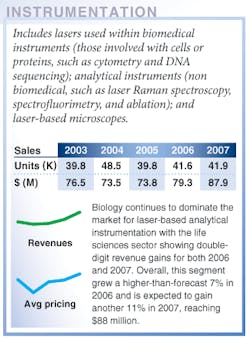

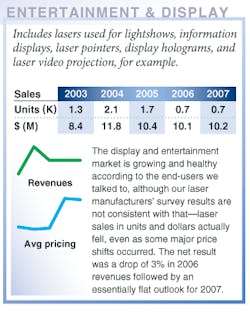

Entertainment & display

The entertainment market is another area in which DPSS lasers have all but displaced gas lasers. According to Bill Benner, president and CTO of Pangolin Laser Systems (Orlando, FL)-which supplies 90% of the software used in laser displays and saw 40% revenue growth in 2005-advances in DPSS lasers have significantly impacted the entertainment business in a number of ways.

“This industry is definitely growing, and part of what is fueling this growth is DPSS lasers. Not only are they replacing the gas lasers but also the power levels continue to go up and the price continues to go down, which increases the accessibility of lasers for light shows,” he said. “So we are seeing them being used again in churches and trade shows and smaller venues of that nature because the cost of the laser, scanner, and even the controller has all come down. Almost no one uses ion lasers anymore.”

In addition, because the wavelengths are visible to the eye, lower-power DPSS lasers can be used, which further decreases the complexity and utility requirements of laser-light-show systems, making the technology more accessible for a wider variety of users. And while certain regulatory requirements have inhibited this market in the United States (see www.laserfocusworld.com/articles/250398), this trend is also changing, according to Benner.

“Historically in the United States you needed a variance from the Center for Devices and Radiological Health (CDRH) if you wanted to install a laser greater than 5 mW,” he said. “But there have been some changes-the CDRH has implemented an electronic method for submitting the variance application, which has simplified and streamlined the application process. In addition, one of the factors that has really driven the laser-light-show market outside of the United States is audience scanning, and there has long been a myth that audience scanning is illegal in the United States. But in July 2006, Pangolin and LFCI collaborated in getting a U.S. CDRH variance for audience scanning, so this technique can now be done in the United States also.”

Despite such positive comments, however, sales of nondiode lasers for this market actually fell about 3% overall in 2006. But buried in the overall number was a 10% increase in DPSS lasers sold for entertainment.

Military/aerospace

As one might expect, given the ongoing conflict in Iraq combined with the highly visible efforts to beef up homeland security at all levels, sales of nondiode lasers into military and aerospace applications apparently jumped by 44% in 2006 to more than $67 million. Nonetheless-as we note every year-this market more than any other is characterized by a lack of transparency. Few suppliers of military hardware are interested in discussing the details except in the vaguest terms. So even laser suppliers are often not fully aware of the ultimate use to which some of their products may be put (though they may have a pretty good idea).

Nonetheless there’s little doubt that lasers and photonics are finding an increasing number of applications in this arena. High-profile research continues-such as the airborne-laser project (see www.laserfocusworld.com/articles/248121)-as does development of solid-state laser and other “directed energy” weapons (see www.laserfocusworld.com/articles/212412). And DARPA continues funding developments in areas it thinks may ultimately have an impact in the defense arena (such as high-power fiber lasers). Though in one development earlier this year hopes for laser-based IR counter measures for use on commercial airliners seemed to fade somewhat as a result of concerns related to cost and operational viability of the systems on a “real world” commercial basis (see www.laserfocusworld.com/articles/272154). That said, a lot of funds are being directed into military applications of photonics and there’s little doubt our industry will be the beneficiary-though we may not always know it.

Other segments

Market segments not specifically discussed above but that are listed in our tables include: inspection and measurement, optical communications, barcode scanning, and data storage. Most of these are either segments that have moved solidly into the diode-laser camp (like barcode scanning) or they involve a mixture of many smaller applications that do not lend themselves to a detailed discussion in the space available. The major diode-laser markets will be addressed in detail next month.

REFERENCES

1. D. Barboza, New York Times (Nov. 15, 2006).

2. Y.P. Sun, et al., J. Am. Chem. Soc. 128(24) 7756 (June 2006).

The Laser Focus World 2007 annual review and forecast of the laser markets is conducted in conjunction with Strategies Unlimited (Mountain View, CA; a PennWell company). Part I of the review reports on the overall market and focuses on nondiode laser applications. Part II, written by Robert Steele of Strategies Unlimited, covers the diode-laser marketplace and will be published next month. -Ed.

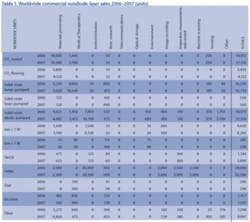

Presenting the data

Nondiode-lasers sales data for 2006 and 2007 are charted in detail by application and by type in Fig. 2 and 3, respectively. Nondiode-laser sales data by unit shipment and dollar revenues are shown in Tables 1 and 2, respectively-corresponding charts and tables for diode lasers will appear next month. For an explanation of our methods, see “Where the numbers come from” on p. 95.

The data presented in the tables here are available with additional commentary in the January 1 issue of Optoelectronics Report (see www.optoelectronicsreport.com) The survey data will also be analyzed at the 20th annual Laser and Photonics Marketplace Seminar on Jan. 22. Held during Photonics West (San Jose, CA) the seminar is hosted by Laser Focus World in conjunction with Strategies Unlimited. (For more information, see www.marketplaceseminar.com).

null

null

Where the numbers come from

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Diode-laser market information is provided by Strategies Unlimited (Mountain View, CA). Industrial-laser market information is provided by Industrial Laser Solutions, and the Medical Laser Report newsletter provides the medical market analysis. This review is the only major survey of its kind in this industry whose results are made public.

For many, both inside and outside the industry, from private-sector investors to foreign and U.S. government bodies, this report is the only objective summary of major trends in our industry that is readily available. Part I examines the overall market trends with more detail on nondiode lasers. Part II will be published in February and will cover the diode-laser marketplace.

Readers interested in the detailed results of both surveys will find them in the January 1 and February 1 editions of the Optoelectronics Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, will be available to attendees at the Lasers and Photonics Marketplace Seminar, held in conjunction with Photonics West (San Jose, CA) on January 22. For more information see www.marketplaceseminar.com.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 2006. We asked manufacturers to provide a confidential estimate of total worldwide market size (dollars and units) for 2006, based on year-to-date actual data, and a forecast for 2007. In addition to the information provided by the manufacturers, we also used data from other more narrowly focused market surveys, and we incorporated commentary provided by industry analysts who added market insight for specific segments.

Changes from last year

A comparison of last year’s 2006 estimates with this year’s restated 2006 numbers will show differences and occasional discontinuities in the numbers reported as compared to last year. In general, no attempt has been made to explain these differences in detail. We request “bottom-up” market estimates, and the respondents to our survey do vary from year to year-both in terms of the companies involved and the individuals-so variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 2006 last year and for 2006 this year may also reflect whatever degree of optimism or pessimism was inherent in last year’s forecast (see Laser Focus World, January 2006, p. 78; www.laserfocusworld.com/articles/245112). -SGA

About the Author

Kathy Kincade

Contributing Editor

Kathy Kincade is the founding editor of BioOptics World and a veteran reporter on optical technologies for biomedicine. She also served as the editor-in-chief of DrBicuspid.com, a web portal for dental professionals.

Stephen G. Anderson

Director, Industry Development - SPIE

Stephen Anderson is a photonics industry expert with an international background and has been actively involved with lasers and photonics for more than 30 years. As Director, Industry Development at SPIE – The international society for optics and photonics – he is responsible for tracking the photonics industry markets and technology to help define long-term strategy, while also facilitating development of SPIE’s industry activities. Before joining SPIE, Anderson was Associate Publisher and Editor in Chief of Laser Focus World and chaired the Lasers & Photonics Marketplace Seminar. Anderson also co-founded the BioOptics World brand. Anderson holds a chemistry degree from the University of York and an Executive MBA from Golden Gate University.