Review and forecast of the laser markets Part II: Diode lasers

The Laser Focus World 2003 annual review and forecast of the laser marketplace is conducted in conjunction with Strategies Unlimited, an optoelectronics market research firm based in Mountain View, CA. Part II covers the diode-laser marketplace. Part I, which reported on nondiode-laser markets, appeared last month.

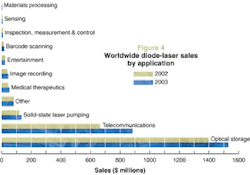

The diode-laser market embodied both bad news and good news in 2002. The bad news is that the market declined by 16% to $2.40 billion compared to 2002, primarily because of the continuing depression in the telecommunications equipment market, which in turn drove down the telecommunications laser market. The good news is that the optical-storage market grew by an astounding 82% to reach $1.40 billion, driven largely by accelerating consumer adoption of the DVD format. Other application sectors, which account for about 14% of the market showed a modest 8% decline. If telecom lasers are excluded, the diode-laser market grew by a robust 53%.

The continuing shrinkage of the telecom laser market, in combination with the rapid growth of the optical-storage market, has resulted in a situation that has not been seen in many years: optical-storage lasers now account for the largest share of the diode-laser market. In recent years, telecom lasers have accounted for nearly two-thirds of the market. In 2002, however, optical-storage lasers accounted for 58% of the market, while telecom lasers fell to 28%—a dramatic turnaround from recent history.

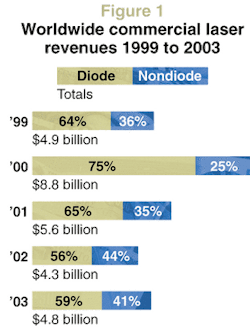

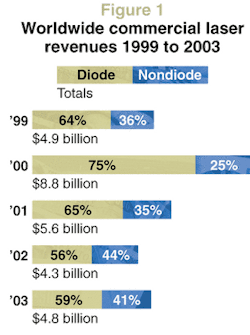

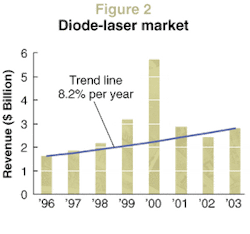

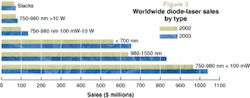

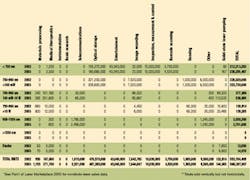

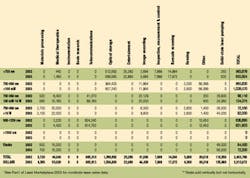

With two years of shrinking sales, the diode-laser market is at its lowest point since 1999. However, with a continuing healthy market growth in optical storage, a projected turnaround in the telecom components market, and modest growth projected for most other applications, a 17% growth to $2.81 billion is forecast for 2003. The recent history of the overall laser market is shown in Fig. 1, and of the diode-laser market in Fig. 2. Diode-laser sales data for 2002 and 2003 are charted in detail by application and by type in Fig. 3 and Fig. 4. Diode-laser sales data by unit shipment and dollar revenues are shown in Table 1 and Table 2 respectively.

null

Telecommunications

The downturn in the telecommunications market that began in 2001, following the bubble of 2000, continued with a vengeance into 2002. Capital investment by telecom carriers continued to shrink, exacerbated by financial problems at major carriers such as WorldCom, Qwest, and Global Crossing. The equipment market also continued to decline. Component suppliers, being at the end of the "food chain," were impacted not only by falling equipment markets, but also by the fact that most equipment suppliers had large stocks of component inventory. The net effect was that the market for telecom components declined by an even larger percentage in 2002 than it did in 2001. The sad tale is illustrated by the 2002 revenue declines by major optical component suppliers:

- Alcatel Optronics: -84%

- Corning Photonics: -83%

- JDS Uniphase: -73%

- Agere Optical Components: -83%

- Nortel Optical Components: -85%

Overall, the optical components market fell by 73% in 2002, compared to 35% in 2001.

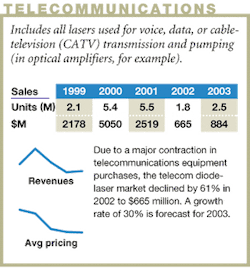

Sales of telecom lasers, which include both transmission (1300 to 1550 nm) and pump lasers (980 and 1480 nm) for optical amplifiers, fell from a revised figure of $1.72 billion in 2001 to $665 million in 2002 (-61%). Transmission lasers fared somewhat better than pump lasers, falling $1.20 billion to $600 million (-50%). The pump laser market fell by a precipitous 87.5%, from $521 million in 2001 to $65 million in 2002. The reason for the disconnect between the two market figures

is that pump lasers are included in optical amplifiers that are installed only in new long-haul system builds. With the dramatic drop in new system installation, plus inventory effects, the demand for pump lasers has virtually evaporated. Transmission lasers also suffer from these effects, but there is an ongoing requirement for lasers in line cards that are added to existing dense-wavelength-division-multiplexing (DWDM) terminals to upgrade system capacity. Also, transmission lasers (in the form of transceivers) are used in metro networks, which have not suffered the same steep market decline that long-haul systems have.

After two years of dramatic decline, there is reason for optimism in 2003. Although the market for telecom equipment is not expected to show significant recovery until 2004, the upturn in the component market is expected to occur in 2003 because equipment makers have nearly depleted the excess component inventories that were held over from 2000. They will, therefore, need to increase their component orders next year, even if equipment installations remain at their current modest levels.

Tom Hausken, director of optical communications components at Strategies Unlimited, provides the following perspective: "When we reviewed the market situation last April, we predicted that this market would begin turning around by 2003. Our updated analysis reaffirms this prediction. However, the market will by no means return to the heyday of 2000 anytime soon. The pie will grow, but there are still too many companies trying to get a piece of it. Specific company performance will be very uneven."

Telecom lasers are forecast to increase 33% to $885 billion. This growth encompasses a 30% increase in transmission-laser sales to $780 million, and a 62% increase in pump-laser sales to $105 million. While this projected growth seems substantial, it should be kept in mind that the 2003 telecom laser market will still be smaller than the market in 1996.

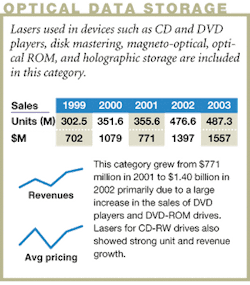

Optical storage

The $1.4 billion optical-storage market for diode lasers was the bright spot in the market in 2002. This was primarily due to a huge run-up in consumer demand for DVD-based drives, and secondarily to a similar, though smaller in unit terms, growth in demand for CD-RW drives. The market for optical-storage drives is largely a consumer market, and includes CD-type drives (780-nm laser)—CD audio, CD-ROM (data storage), CD-RW, CD-ROM video games, and Video CD (sold primarily in Asia); the MiniDisc format (780-nm laser), Read-only and Rewritable; and DVD-type drives (650 nm laser)—DVD video, DVD-ROM (data storage), DVD-ROM video games, DVD±RW, and DVD RAM

Of these applications, CD-audio is very mature and slow growing. CD-ROM is actually declining because the personal computer market has stagnated in recent years, and more and more PCs come equipped with CD-RW drives or DVD drives or a combination of these, rather than CD-ROM drives. CD-ROM video games, such as the Sony Playstation have largely been supplanted by DVD-ROM video games such as the Playstation2 and the Microsoft Xbox.

With the decline in the CD-based optical-storage market, it is the DVD-based drives that have propelled the optical-storage diode-laser market to new heights in 2002. Although it has grown steadily since the DVD was first introduced in 1997, the market for DVD players took off in 2002, soaring to more than 50 million units worldwide, as prices underwent a dramatic drop, to less than $100 for some low-end models, and the number of DVD titles proliferated (currently more than 15,000). It is estimated that more than 30% of U.S. households have DVD players, and the DVD format has become so popular that some video retailers have announced that they may cease VHS movie sales altogether.

DVD-ROM based video games have also surged in popularity, with player sales exceeding 40 million units in 2002, led by the Sony Playstation2. DVD-ROM drives for personal computers have also steadily increased sales in recent years.

As a result of the dramatic growth in DVD-format optical-storage devices, the sales of 650-nm diode lasers grew to 148 million units in 2002, accounting for revenue of $448 million. Included in this total were 46 million dual-wavelength (650- and 780-nm) lasers, which were introduced by Sony, Sharp, and Toshiba in 2001. Almost all DVD players and all DVD-ROM drives include 780-nm lasers so that they can read CD audio and CD ROM media, respectively. Before 2001 separate lasers were required to provide both functions. Since their introduction last year, dual-wavelength lasers have seen increasing use in DVD-format drives.

In addition to the lower-power 650-nm lasers used in DVD read-only applications, an additional 7.5 million 650-nm, 30-mW lasers were sold in 2002 for rewritable DVD drives, including DVD+RW, DVD-RW, and DVD-RAM formats. Despite the proliferation of different standards in this market, rewritable drives have become increasingly popular for video recording and are now routinely included in some of the higher-end PC models, as well as sold on a stand-alone basis for video recording.

Another positive aspect of the optical-storage diode-laser market in 2002 was the growth in CD-RW drives. These drives have become popular for "burning CDs," with MP3 music files, as well as for storing digital images and for general data backup. An increasing percentage of personal computers come equipped with a CD-RW drive, and large numbers are also sold in the aftermarket as add-on internal or external drives. The 780-nm, 40-mW lasers used in CD-RW drives (and also in recordable MiniDisc players) reached 89 million units in 2002, accounting for $615 million in revenue.

The fall-off in CD-ROM sales, and the increasing use of dual-wavelength lasers in DVD-type drives has resulting in an annual decrease in the sales of 780-nm, 5-mW lasers used in CD-type drives. In 2002, the sales of these lasers fell by 10% to 232 million units, accounting for $269 million in revenues. The decrease has been moderated somewhat by the dramatic growth in DVD-type drives, most of which still use a 780-nm laser to read CD media, as noted above, with dual-wavelength lasers still used in only a minority of such drives.

Following an 82% revenue growth (to $1.4 billion) and a unit growth of 38% (to 477 million) in 2002, the forecast for 2003 seems somewhat conservative: $1.56 billion in revenue and 487 million units. This forecast may reflect supplier conservatism more than market realities. However, it is important to note that the total for 2003 includes a projected decline of 14% in low-power 780-nm laser units (used in CD-base drives), which still make up nearly one-half of the unit total.

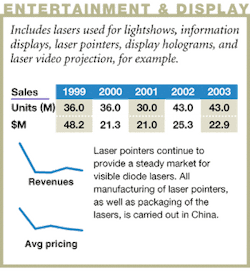

Entertainment, display/inspection, and measurement/barcode

Entertainment and display for diode lasers primarily refers to laser pointers, and has become a mature market. Virtually all laser pointers are produced in China. In addition, all the visible diode lasers used in these products are also packaged in China. The laser chips are produced in Taiwan, and a very low-cost, chip-on-board approach is used to package them. Despite some reports that sales were dropping in recent years, more recent information indicates that the market has held steady at around 40 million units per year, but the revenue is relatively low, at $25 million, due to the low-cost packaging.

A related market category is inspection and measurement, which includes applications such as surveying instruments, laser levelers, laser gun sights, and so on. These applications use low-power visible (red) diode lasers similar to those used in laser pointers. Taiwan is also the source of most of these lasers (Japan supplies some of the higher end units), and the devices are packaged in Taiwan in standard TO-type packages. This market is around 10 million units per year, and generated $8 million in revenue in 2002.

Another category that uses the same type of low-power visible diode laser as the two described above is barcode scanning. This application, which includes fixed, handheld, and portable scanners, has experienced steady growth for many years, but 2002 was relatively flat in terms of units, possibly due to the slow economy. Due to declining laser prices, revenues fell by 23% to reach $14.7 million.

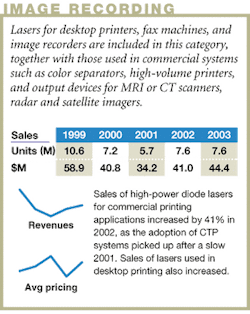

Image recording

The image-recording category includes both desktop printing and commercial printing and graphic arts. The market for diode lasers (780 nm, 5 mW) used in desktop printing (laser printers and digital copiers) has been declining in recent years, but in 2002 increased to 7.5 million units, probably due to the increased popularity of digital copiers, the prices of which have fallen dramatically.

The commercial-printing market picked up in 2002, after a relatively flat year in 2001. Commercial-printing and graphic-arts applications of diode lasers involve computer-to-plate and computer-to-press (CTP) technology in which an array of 1-W lasers is used to expose thermally sensitive printing plates directly from digital files. Although this technology allows for substantial reduction in labor and materials costs, and increased workflow and efficiency, printers must make substantial capital outlays to upgrade from their old plate-making equipment. While it would be natural to think that such capital expenditures would slow down in a slow economy, 2002 nevertheless saw a 41% increase in the market for diode lasers used in commercial printing to $29 million.

Part of the upturn in the commercial-printing market was due to the increased use of violet diodes (approximately 400 nm) in newer CTP systems that were introduced at the 2001 DRUPA show in Germany, primarily for smaller (two- and four-page) presses. Violet-diode-based CTP systems are making use of improved photopolymer plate coatings that can be used for up to 1 million impressions, similar to thermal plate coatings, and so are increasingly being adopted in the smaller presses. Thermal systems remain the dominant CTP system for the larger (eight pages and up) presses. For 2003, growth of 12% to $32.5 million is forecast for the commercial printing use of diode lasers.

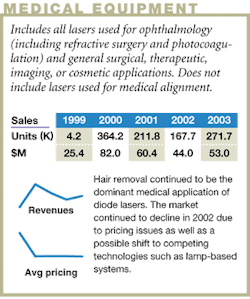

Medical

In 2002 hair removal remained the primary medical application. Sales of high-power diode lasers for hair removal accounted for $40 million, or 89% of the medical diode-laser market. The hair-removal market includes both large fixed systems, such as the Lumenis LightShear, as well as smaller handheld systems. The former utilize 1-kW stacks of 50-W diode bars, while the latter use either discrete diodes or bars. The discrete-diode systems are mainly for overseas use and are not approved by the FDA in the United States.

The market for diode lasers used in hair removal appears to have fallen in revenue terms, as well as in units. For the larger fixed systems, this may have to do with the economic slump or perhaps a shift to nonlaser technologies such as lamps used in intense pulsed systems. Also, there was a pricing issue related to the way in which the stacks used in large fixed hair-removal systems are evaluated. Because these lasers are packaged exclusively by the equipment maker, there is no end-market "price," so an effective price must be estimated. Since the price estimate in 2002 was lower than in 2001, the corresponding revenue figure is lower.

Ophthalmic use of high-power diode lasers, especially photocoagulation, continues to be a steady, if relatively small application. Other medical uses of diode lasers include visible lasers used in photodynamic therapy for treating age-related macular degeneration (AMD), as well as in low-level light therapy.

Solid-state laser pumping

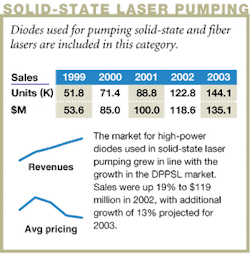

The market for diode-pumped solid-state lasers (DPSSLs) used in applications such as materials processing, medical therapeutics, instrumentation, and basic research, among others, has experienced robust growth over the past decade, and 2002 was no exception. Despite 2002 being a year in which there was little growth in many laser types, unit sales of DPSSLs grew by 38% (see Laser Focus World, January 2003, p. 73). Pump lasers remained the largest application for high-power diode lasers, accounting for $119 million in revenue in 2002, an increase of 19% over 2001.

The use of diode lasers for pumping ranges from microlasers to low-power DPPSLs (5 to 20 W), to fiber lasers and to high-power (kilowatt-class) industrial lasers such as those offered by Rofin-Sinar (Plymouth, MI; Hamburg, Germany) and Trumpf (Ditzingen, Germany). The latter category of DPPSLs was introduced several years ago, and has found increasing acceptance in industrial applications due to higher beam quality, higher reliability, and lower operating costs as compared to lamp-pumped lasers. As a measure of the success and potential for future growth of these lasers, in 2002 Trumpf acquired Princeton Lightwave (Cranbury, NJ) to provide an in-house source of pump diodes (Rofin-Sinar had earlier acquired DILAS Diodenlaser for the same purpose).

Solid-state laser pumping includes military as well as civilian applications. According to Merrill Apter, vice president of worldwide sales for Coherent's semiconductor business unit, the outlook for military applications is especially strong as the United States expands its military capabilities to fight the war against terrorism. Several military platforms will incorporate DPSSLs, including the Northrup Grumman Viper, Lockheed Martin C-130 gun ship, BAE Joint Strike Fighter, and the U.S. Army High Energy Laser program. All of these programs generally require high-power QCW stacks that incorporate diode bars capable of high peak power and high efficiency at elevated temperatures (55∞C to 70∞C).

With increasing demand, both commercial and military, for DPPSLs and their associated pumps, the market for pump diode lasers is forecast to grow by 14% to $135 million in 2003.

Other

Several of the smaller application categories that were not included in any of the preceding discussion are worth mentioning. Materials processing includes primarily direct-diode industrial applications such as soldering, adhesive curing, plastic joining, heat treating, and even welding. Although accounting for just $3.4 million in diode-laser sales in 2002, materials processing continues to make commercial inroads as companies such as Rofin-Sinar, Nuvonyx, (Bridgeton, MO), Laserline (Müelheim-Kärlich, Germany), and others pioneer new applications.

The sensing category, accounting for $5.6 million in diode-laser sales in 2002, is addressed by both high-power and low-power lasers. Low-power lasers primarily include vertical-cavity devices (VCSELs), which are beginning to be used in a variety of new applications, including photoelectric controls, mouse pens, and optical encoders. High-power applications use mainly high-peak-power pulsed diodes and are more mature. They include industrial robotics, surveying instruments, and range finding.

The category termed "Other" in Tables 1 and 2 includes primarily military/aerospace and local area networks (LANs). Most military applications involving lasers have evolved to DPPSLs in recent years, and thus there is a significant portion of the pump-diode market that is oriented toward military applications. However, these are not broken out separately in the pump-laser statistics. The use of direct diode lasers in military applications was modest at $1.6 million in 2002, but represents a continuing steady market. Most military applications involve the use of high-peak-power pulsed diodes that are used in applications such as weapons simulation for war gaming, proximity fuses for missiles, and range finding.

In the LAN category, which includes both true local-area networks, based primarily on Ethernet, and storage-area networks, based primarily on Fibre Channel, 2002 saw a continuation of the downward trend experienced in 2001. Unlike the telecom market, which experienced a true "bubble" in 2000, the data network market has suffered not from over investment but rather a reduction in capital spending, especially in the information technology sector, on the part of corporations. Although the economy made modest gains in 2002, capital spending did not return to former levels, and the technology sector has continued the recession begun in 2001.

For the diode-laser market, the main impact has been from a reduction in the sales of optoelectronic components, primarily fiberoptic transceivers operating at data rates of 1 Gbit/s and above that are incorporated into the switches and network interface cards that constitute the critical elements of data networks. Transceivers use either 850-nm VCSELs or 1300-nm Fabry-Perot lasers, depending upon the distance over which data is transmitted. As in the case with telecom lasers, the market for these components has been affected not only by the slowdown in the end equipment market, but also by inventory effects. As a result the sales of 850-nm VCSELs and 1300-nm lasers used in data networking fell by 35%% to $79 million in 2002. Because of the lack of visibility of the major components suppliers beyond even the next quarter, the 2003 market for these components is forecast to be flat.

Another area in which 850-nm VCSELs were expected to play an increasing role was parallel optical interconnects. These data links, which can transmit up to 40-Gbit/s, are used primarily to interconnect large telecom switches and routers and to provide optical backplanes inside such equipment. Their adoption depends largely on the growth in the telecom equipment market, which was still in the doldrums in 2002. Therefore, the market for VCSEL arrays used in parallel interconnects simply did not materialize.

ROBERT V. STEELE is director of optoelectronics at Strategies Unlimited, 201 San Antonio Circle, Suite 205, Mountain View, CA 94040.

Diode-laser products and configurations

The diode-laser revenue figures shown in Table 2 are based on the unit sales figures in Table 1 and average selling prices (ASPs) for each type of diode laser. The ASPs for diode lasers vary widely and are a function of wavelength, power output, and package type. The revenue figures are for packaged devices as they are sold by diode-laser suppliers to the merchant market or transferred internally to other company divisions to be used in system level products. Diode-laser packaging is subject to a wide range of configurations according to the device type and application requirements, and includes variations such as thermal control and fiber coupling. Short-wavelength (<1000-nm) diode lasers at power levels of less than 200 mW are almost always single-lateral-mode, single-stripe devices that are sold commercially in hermetically sealed TO-type packages. The lasers are typically mounted on a heat sink, and the complete package includes a back facet photodetector for monitoring the laser output level. The selling prices of such devices range from less than $1 for a high-volume CD-type laser to around $2 for a low-power visible (650-nm) laser to around $9 for a 30-mW, 650-nm laser used in rewritable DVD applications. Some low-volume specialty devices can be priced much higher.

An increasingly important packaging concept in the low-power 750- to 980-nm diode-laser market, particularly in audio CD and CD-ROM applications, is to carry out hybrid integration of the diode-laser chip, detector chips, and optical elements in a single package. These integrated optical pickups are lower in cost than pickups fabricated from discrete components and result in easier assembly for the CD player or CD-ROM drive manufacturer. Sony introduced this concept in 1991 for its very thin (15-mm) Walkman CD player. Such pickups are now manufactured in volume by Sony, Sharp, and Matsushita with prices averaging around $1.80, compared to less than $1 for a discrete packaged diode laser. The value of such pickups is included in the diode-laser market revenues in Table 2.

For high-power diode lasers (>1 W) there is a wide range of power levels and configurations. Up to 5-W CW, a wide (up to 500-µm) single-stripe, multimode device is the norm. These devices are usually supplied in TO-type packages that can include Peltier coolers for temperature control. Beyond about 5 W, the only commonly used approach is a multi-stripe, multimode array. The standard product at these power levels is a 1-cm wide diode-laser bar, which consists of a single multi-stripe array or a grouping of several arrays to build up higher power levels. Pricing for high-power diode lasers ranges from under $200 for a 1-W discrete device in quantity up to $2000 for a 50-W bar. Single laser bars are now available at power outputs up to 40-W CW, although 20 W is still the most common configuration. Increasingly, these high-power devices are sold with fiber coupling to provide a more usable output beam for the end user. Higher-power arrays are typically available on a heat-sink submount that can be attached to a water-cooled heat removal system. For applications requiring high peak power, these arrays can be operated in the pulsed (quasi-CW, or QCW) mode at peak powers up to 100 W.

For power levels above 40-W CW, high-power diode-laser bars can be stacked in the vertical dimension (these products are included the Stacks category in Tables 1 and 2). Because of the difficulty in removing heat from such a configuration, these stacks are typically operated in the QCW mode. Peak output power approaching 5 kW can be achieved from such a stack. The packages for these devices typically include water cooling, although conduction cooling may be used in lower duty cycle devices. With the development of more efficient heat removal techniques (microchannel coolers, for example), CW stacks have become available.

The packages for long-wavelength (>1000-nm) diode lasers used in telecommunications applications include special adaptations for coupling the laser output to single-mode (approximately 9-µm core diameter) optical fiber with tolerances on the order of ±1 µm. These are in the form of fiber pigtails or single-mode connectors. Telecommunication laser packages may also include other elements such as thermoelectric coolers for temperature control and optical isolators to reduce the amount of light reflected from the fiber back into the laser. All laser packages include back-facet monitor photodiodes. Because of the expense of fiber coupling and other package features, telecommunications diode lasers typically have high ASPs. Prices range from less than $100 for the lowest performance Fabry-Perot devices in a connectorized coaxial package to several thousand dollars for a high-performance distributed feedback (DFB) laser in a cooled butterfly package with fiber pigtail. Diode lasers used in short-distance data communications applications with multimode fiber have much lower prices—850-nm VCSELs packaged in several different configurations, for example, are priced at well under $10.–RS

Where the numbers come from

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Information about diode-laser markets is provided by Strategies Unlimited (Mountain View, CA). The review is the only major survey of its kind in this industry whose results are made public.

For many, both inside and outside the industry, from private-sector investors to foreign and U.S. government bodies, this report is the only objective summary of major trends in our industry that is readily available. Part I, published in January, looked at the overall market trends with more detail on nondiode lasers. Part II covers the diode-laser marketplace.

Readers interested in the detailed results of both surveys will find them in the Jan. 1 and Feb. 1 editions of the Optoelectronics Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, was available to attendees at the Laser and Optoelectronics Marketplace seminar, held in conjunction with Photonics West (San Jose, CA) on Jan. 27. To obtain Proceedings of the seminar, see www.marketplaceseminar.com.